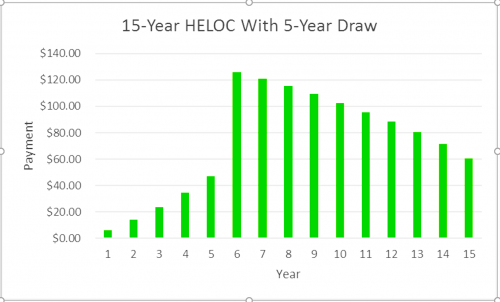

During this time, you also have the option to make payments back against the principal. When that period ends, you must make principal and interest payments.

What Is The Heloc Draw Period How To Prepare For The Draw Period End Mybanktracker

Be aware, however, that you’ll make payments on the loan during both periods.

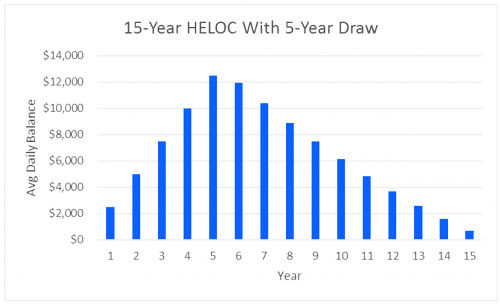

Figure heloc draw period. These draws will get a different interest rate. Draw periods may range from 5 years to 20, but the average tends to fall in the middle. Once the heloc transitions into the repayment period, you aren’t allowed to withdraw any more money, and your monthly payment.

As you repay the initial draw, you can take additional draws up to 20% of your original loan amount, which is the initial draw amount plus the origination fee. A heloc has two phases that separate borrowing and repayment, also known as the draw period and the repayment period. What is a heloc draw period?

However, you average daily balance on your heloc for that month was actually $17,500. If you would like to calculate the size of the home equity line of credit you might qualify for, please visit the heloc calculator. Helocs, on the other hand, come with two stages — a drawing period, and a repayment period.

If your figure heloc is secured by property located in oregon, please contact our customer. A figure home equity line and credit cards can provide funding in as little as five days 2, which is unavailable with traditional helocs. If you have additional questions, please contact us at loans@figure.com opens a new window.

(1) an “auto pay” discount of 0.25% for setting up automatic payment (at or prior to heloc account opening) and maintaining such automatic payments from an eligible bank of america deposit account; The initial amount funded at origination will be based on a fixed rate; You make minimum payments during your draw period.

Typically, a heloc’s draw period is between five and 10 years. However, this product contains an additional draw feature. The initial amount funded at origination will be based on a fixed rate;

Unlike many helocs, figure's home equity line requires borrowers to take the full amount upfront. As of early april 2021, the. The draw period is the predetermined length of time you can use your revolving line of credit.

Figure promises an easy online application process with approval in five minutes and funding in as few as five business days. For figure heloc and personal loan members, confirm that your loan is not more than 30 days past due, and you have paid any past due amounts prior to submitting this request. Figure could be a good option for borrowers who need fast cash.

Mortgage comes out the 10th of every month, car payments, the 5th, student loans and credit cards on the 20th. Payments and due dates vary depending on when your loan closed. Why figure is the best home equity line of credit for fast funding:

The first phase, called the draw period, is when your line of credit is open and available for use. Helocs are different in that they allow for a draw period in which the borrower pays only for the accrued interest. (2) an initial draw discount of 0.05% for every $10,000 initially withdrawn at account opening (up to 0.75% for initial.

The borrower can then take additional draws once a certain amount has been repaid. During the draw period you do not have to spend all the credit you are extended, and you only pay (usually) on the money you spend. You still end up at the end of the month with $19k owed to your heloc.

X research source draw periods on helocs are usually 5 to 10 years, while. Normally, draw periods last between 10 and 15 years. The following discounts are available on a new home equity line of credit (heloc):

The payments you make during the draw period can revolve and restore your credit. Figure's home equity line offers home equity loans with terms ranging from 5 to 5 years. A home equity line of credit draw period is the time during which a borrower can access the funds from their credit line, up to the total limit.

The draw period will range in time based on the lender and offer, but typical draw periods are set at ten years. Helocs can become a drain on your finances if you put off making payments. Helocs have a draw period, which is when you can take out additional funds.

During the draw period, you can withdraw from your heloc account to. You can find your next payment due date and amount by logging into your figure account or refer to your periodic statement. However, this product contains an additional draw feature.

You can get approved for a heloc with figure in as little as five minutes and get your money in as little as five days.

Home Equity Line Of Credit Qualification Calculator

Heloc End-of-draw Dead End Or New Beginnings - Novantas

Figure Review The Fastest Way To Tap Home Equity

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is A Heloc-a Guide For Homeowners

How A Figure Home Equity Line Works

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Home Value Calculator

8 Tips For Getting The Best Heloc Rates In 2020

Figure Get A Home Equity Line Of Credit Fast - Approval In 5 Minutes

Is A Heloc A Better Alternative For Getting Rid Of High-interest Debt

How A Heloc Works Tap Your Home Equity For Cash

What To Know Before Your Heloc Draw Period Ends Bankrate

How The Coronavirus Is Changing The Heloc Lending Market National Mortgage News

8 Best Heloc Rates Lenders For 2021 Lendedu

Heloc Default Rate Of The Control And Test Samples From The Occ Home Download Scientific Diagram

Heloc Volume By Origination Eod And Maturity Date Entire Sample From Download Scientific Diagram

What To Know Before Your Heloc Draw Period Ends Nextadvisor With Time

Figure 2021 Home Equity Review Bankrate