These two periods last for up to 25 or 30 years. Once the draw period ends, the “repayment period” begins.

What Is A Heloc-a Guide For Homeowners

To calculate the eligible heloc amount check our heloc calculator.

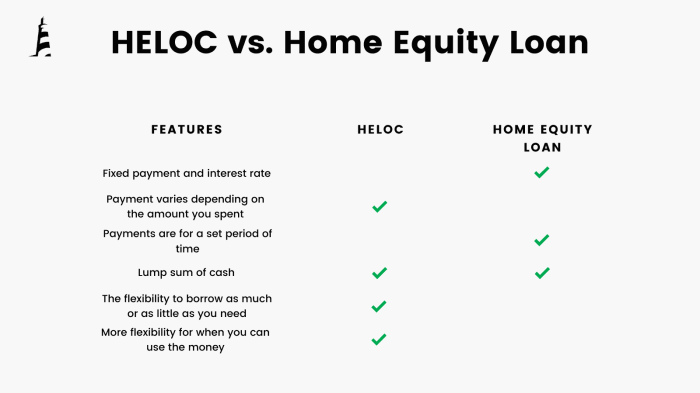

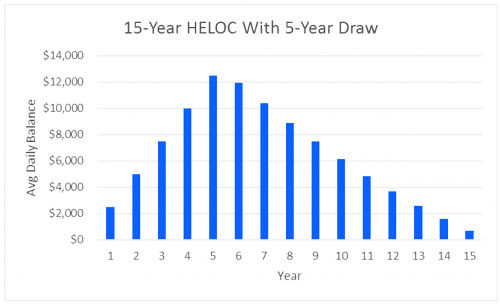

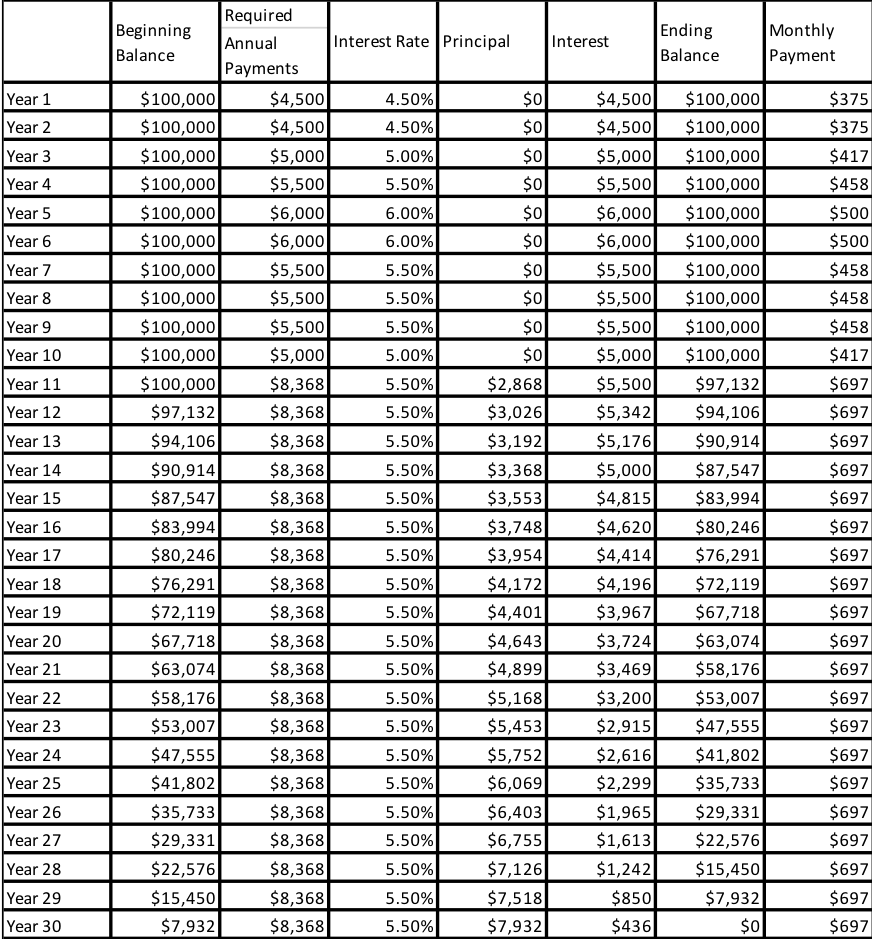

Heloc draw period vs repayment period. There’s also the possibility of keeping a credit line open and stalling repayment by looking for a new heloc at the end of the draw period. However, the payment mechanics still seem ambiguous. Based on my research, there’s typically a draw down period where you only pay interest (typically 10 years) and then a repayment period where you pay interest + principal (typically 15 years).

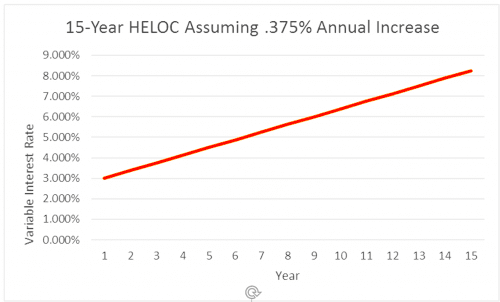

The first phase, called the draw period, is when your line of credit is open and available for use. Once the draw period ends, you are in for some payment shock. Helocs typically feature variable interest rates (although some helocs use fixed rates).

While heloc terms can vary based on the bank issuing the line of credit, they all follow this basic structure: You should take stock of your outstanding balance and decide whether or not you can afford to repay it with your current interest rate before your heloc draw period. During the draw period , you can borrow from the credit line by check, transfer or a credit card linked to the account.

Others could extend the repayment phase over decades. Some lenders may want you to pay back all of the money at the end of the draw period; Once the heloc draw period is over, the repayment period begins.

Heloc repayment periods also vary, but are usually from 10 to 20. Your repayment period will generally be a set number of years, typically 10 to 20. The repayment scenario can play out in a few different ways:

At this time, the borrower begins to repay the borrowed amount for the predetermined term of the loan. Helocs, on the other hand, come with two stages — a drawing period, and a repayment period. During the draw period, a borrower has revolving access to unused amounts under a specified line of credit.

A heloc has two phases: You no longer just pay interest. A repayment period typically lasts 10 to 20 years.

You cannot draw money from the line of credit anymore, and the monthly payments now include principal and interest. However, most helocs cap how much the interest rate can rise at one time and over. Typically, a heloc’s draw period is between five and 10 years.

It’s important to be clear about when the draw period ends in order to adequately prepare yourself for the next phase. Depending on the terms of the loan, you may have a variable rate on the balance as well. It’s a fairly flexible, low cost way of tapping into equity on a home.

The draw period and the repayment period. Making heloc payments after the draw period. You get a repayment schedule whereby you pay back both the principal payment as well as the interest amount every month — depending on how much you’ve borrowed.

Your draw period can last up to 10 years and your only limitation is that you stay within your credit limit. As you approach the end of your draw period, confirm the balance you will owe after the heloc closes, how long your repayment period lasts, and what your monthly payments will be. You’re no longer able to spend any more of the loan, and you’re required to start paying back everything you’ve borrowed, with interest.

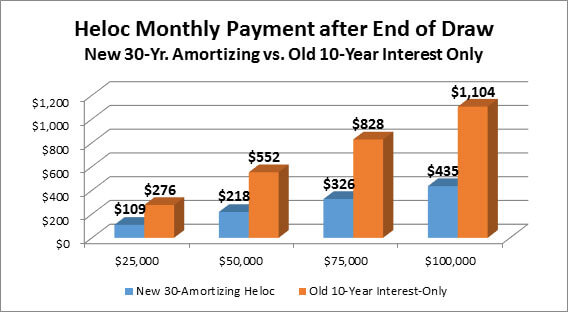

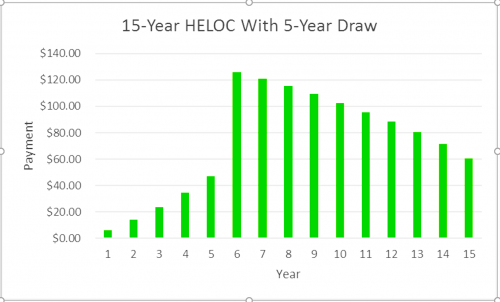

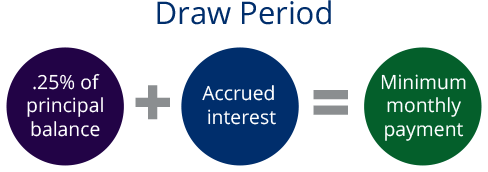

Heloc lender draw period, repayment and interest rate rules vary by the lender. In the draw period, you can borrow funds from the heloc and are only required to make interest payments and do not have to repay the principal. If you only paid interest during the draw period, you will probably see a significant increase in the amount you must pay each month.

Once the heloc transitions into the repayment period, you aren’t allowed to withdraw any more money, and your monthly payment includes principal and interest. You have a draw period, followed by a repayment period. When your heloc draw period ends, you enter the repayment period.

During the “draw” heloc period you can borrow any amount up to the heloc credit limit at any time. A heloc has two phases that separate borrowing and repayment, also known as the draw period and the repayment period. Be aware, however, that you’ll make payments on the loan during both periods.

That’s when you cannot draw more money from the credit line. But it can vary, with some helocs offering 20 year draws and 20 year repayment periods to lessen the payment burden. Helow draw periods usually last between 5 and 15 years and during this time the borrower is required to pay only.

While some helocs allow you to pay interest only during the draw period, when the draw period ends, the repayment period begins, where you cannot take out any additional funds and you will pay back the principal of the loan, along with interest charges. In the repayment period, you have to pay back the principal and interest on the heloc. Typically, a heloc’s draw period is between five and 10 years.

The draw is typically the first 5 to 10 years, followed by the repayment period of 10 to 20 years. Repayment period during the draw period , you are allowed to access your line of credit and borrow as much or as little as you need. Once the heloc transitions into the repayment period, you aren’t allowed to withdraw any more money, and your monthly payment.

Home Equity Loan Vs Heloc Infographic - Discover

Equity Repayment Home Equity Lending Third Federal

Credit Union Blog Financial Articles Coastal Credit Union

How A Heloc Works Tap Your Home Equity For Cash

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

More Home Loan Options To Increase Your Buying Power Heloc Homeloans Mortgages Crestico Mortgagesmadeeasy Lowinterestrates Home Loans Heloc Loan

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Heloc Payment Calculator With Interest-only And Pi Calculations Home Improvement Loans Home Equity Loan Heloc

What To Know Before Your Heloc Draw Period Ends Nextadvisor With Time

Httpswwwbankofamericacomhome-loanshome-equityhome-equity-loan- Payment-calculatorgo Home Equity Line Home Equity Line Of Credit

How A Heloc Works Tap Your Home Equity For Cash

Heloc Volume By Origination Eod And Maturity Date Entire Sample From Download Scientific Diagram

What Is A Heloc And How Does It Work Rodgers Associates

Payment Shock In Helocs At The End Of The Draw Period - Sciencedirect

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Heloc End-of-draw Dead End Or New Beginnings - Novantas

Understanding Home Equity Loans And Helocs - Albuquerque Business First

Essential Differences Between Home Equity Loans And Helocs - Cccu

Calculate Heloc Payments Chase Home Equity Chasecom