We're unable to add the owner's draw on the profit and loss report since it's an equity account. Select the gear icon at the top, then chart of accounts.

Solved Report By Vendor Type And Customer Job

Credit cash / debit owner distribution

Owner draw report quickbooks. From here, choose “make deposits” and then select the bank account where you’d like to deposit your personal investment. Owner's equity represents the owners investment in the business minus the owners draws or withdrawals from the business plus the. Open the profit and loss report.

You should already have an owner’s draw account if you selected sole proprietor when setting up quickbooks. Typically, you use petty cash for small purchases that cost. To record an owner contribution in quickbooks, launch the quickbooks program and click the “banking” tab at the top of the home screen.

You can either enter a check/expense and use the owner’s draw account in the cat. Or pick the transaction, click on the record as switch option, and set the transfer account to owner's equity. To record owner’s draws, you need to go to your owner’s equity account on your balance sheet.

Open the chart of accounts, use run report on that account from the drop down arrow far right of the account name. For a company taxed as a sole proprietor or partnership, i recommend you have the following for owner/partner equity accounts (one set. It will only show on the balance sheet.

How do you record an owner’s draw? To create an equity account: An owner's draw account is an equity account used by quickbooks online to track withdrawals of the company's assets to pay an owner.

This article describes how to setup and pay owner’s draw in quickbooks online & desktop. If you have any questions or would like to see a future video. At the end of the year or period, subtract your owner’s draw account balance from your owner’s equity account total.

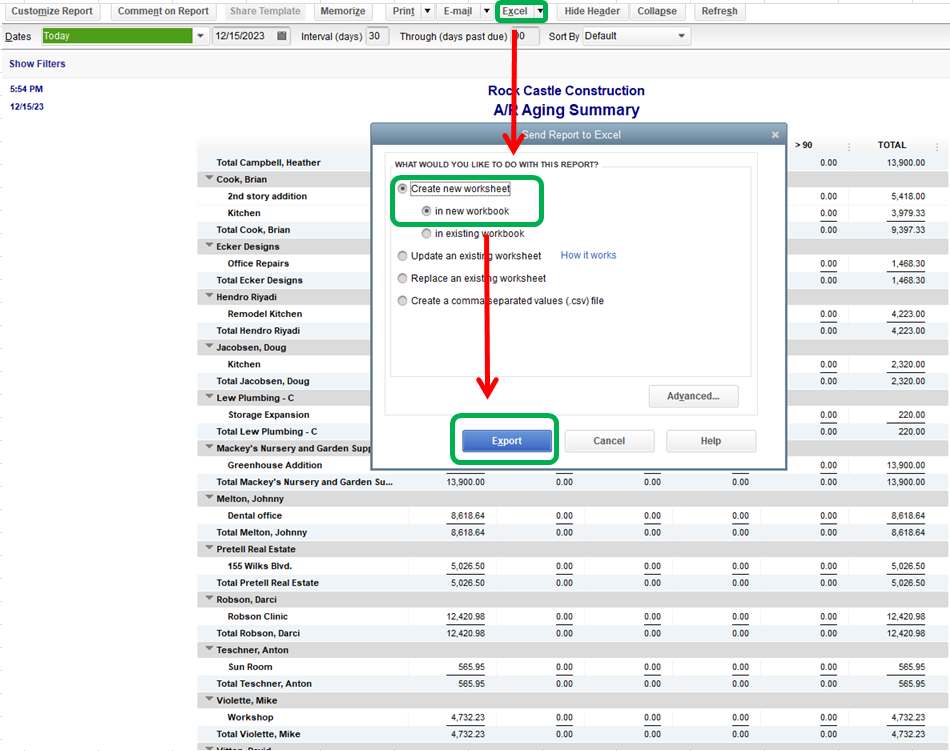

I suggest exporting the profit and loss report, then add the owner's draw amount manually. Select the gear icon at the top, and then select chart of accounts. Entering owners draw quickbooks online.

Your decision about a salary or owner’s draw should be based on the capital your business needs and your ability to perform accurate tax planning. This decision regarding a salary or a draw impacts your business and your personal tax liability. By marie | mar 20, 2016 | bookkeeping 101, chart of accounts setup & management, financial statements & reports, quickbooks for mac, quickbooks for windows, quickbooks online.

Recording draws in quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to the draw accounts. Remember, this is not an expense transaction and is not going to show on the profit and loss report at all. It is also helpful to maintain current and prior year draw accounts for tax purposes.

If you don’t see your preferred bank account listed, you’ll need to add it. Why is my quickbooks profit and loss report not showing owner’s draw? Any money an owner draws during the year must be recorded in an owner’s draw account under your owner’s equity account.

Paying yourself an owner’s draw in quickbooks is easy. Owner's draw because the category, with gst set as out of scope (0%); Take care of business faster with docusign.

Debit cash / credit owner contribution if you withdraw money from the business: Recording owner’s draws to record owner’s draws, go to your balance sheet’s owner’s equity account and debit your owner’s draw account while crediting your cash account. How do i record an owner’s salary in quickbooks?

If not, go to your chart of accounts to create a new account and select equity as the type. To record a transaction between the business and owner’s account, go into the banking menu in quickbooks and select the option titled write checks. This tutorial will show you how to record an owner's equity draw in quickbooks online.if you have any questions, please feel free to ask.

Recording owner’s draw in quickbooks is a quick and easy process that should only take a couple of minutes (assuming you’ve already set up the account using the steps previously mentioned). So if you deposit money to the business: Owner's draw vs payroll salary:

Pick the transaction, click on the categorise option, pick out expense because the transaction type, myself because the supplier/customer and owner's equity. Yeah, there should be two equity accounts on your chart of accounts: Owner contributions and owner distributions.

How to record in quickbooks when an owner withdraws cash from the business account. Set up and pay a draw for the owner. Your profit and loss report is not showing owner’s draw because owner’s draw does not belong on a profit & loss.

An owner’s draw account is a type of equity account in which quickbooks desktop tracks withdrawals of assets from the company to pay an owner. If you're a sole proprietor, you must be paid with an owner's draw instead of employee paycheck.

Learn About Recording An Owners Draw In Quickbooks Pro 2013 At Wwwteachucompcom A Clip From Mastering Quickbo Quickbooks Tutorial Quickbooks Quickbooks Pro

Solved How Do I Get Totals To Show Up On A Check Detail R

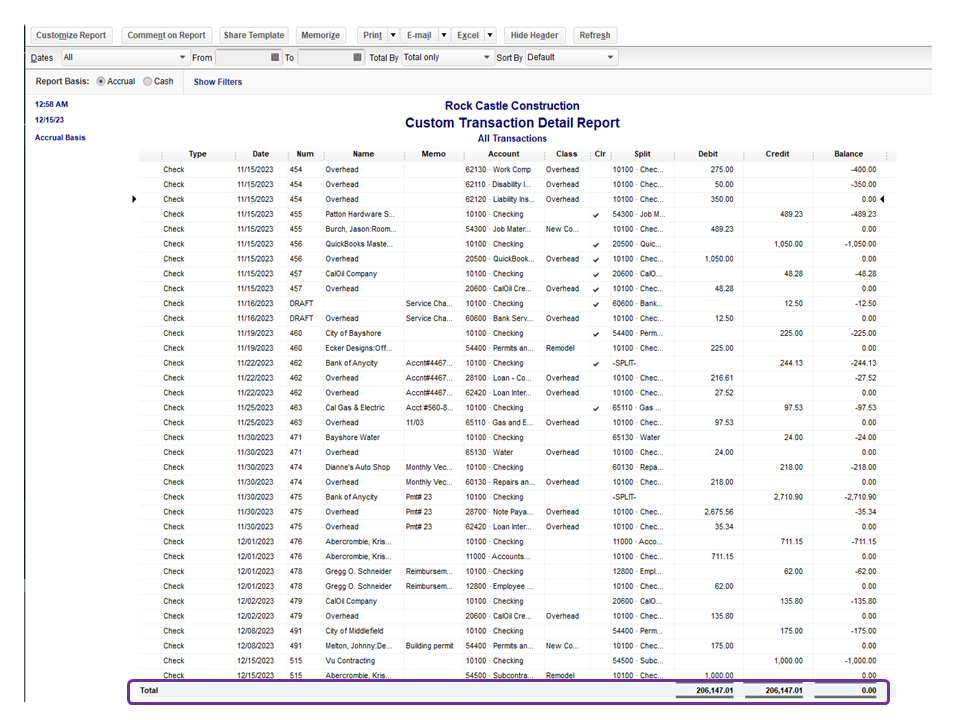

Solved Transaction Detail By Account Report

Exclude Subclasses From Pl Report By Class And S

Owners Draw Balances

How To Delete Memorized Reports In Quickbooks In 2021 Quickbooks How To Memorize Things Report

Setting Up The Quickbooks Chart Of Accounts Chart Of Accounts Accounting Quickbooks

Bank Statement 2 Months The 2 Secrets You Will Never Know About Bank Statement 2 Months How To Memorize Things Quickbooks Weekly Lesson Plan Template

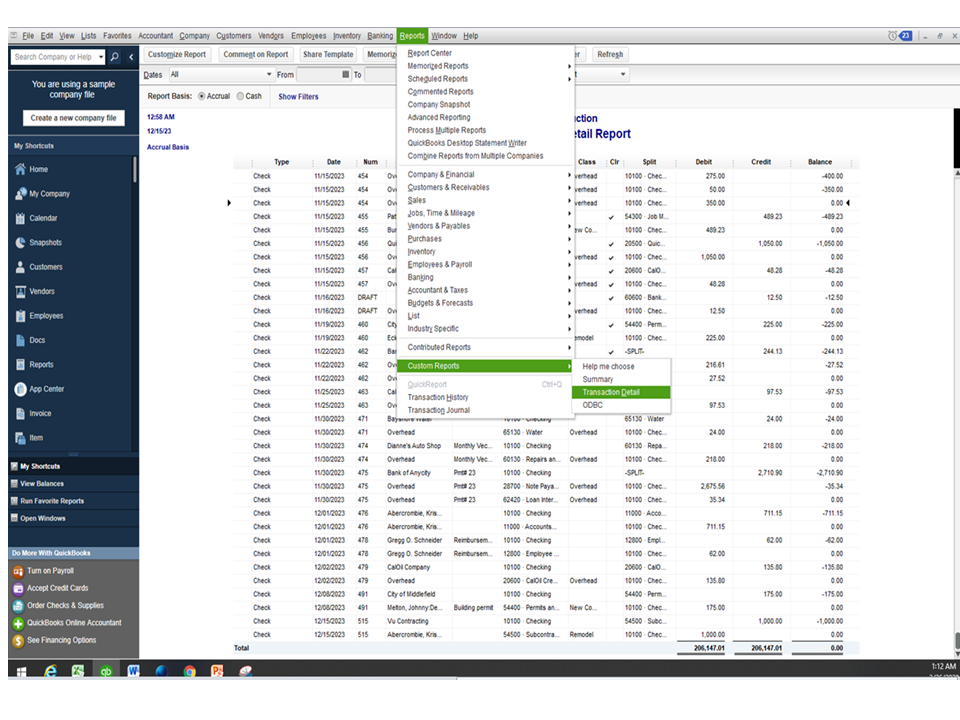

Quickbooks Enterprise Custom Reports And Customized Transaction Detail Reports - Youtube

Monthly Electrical Maintenance Report Format Report Template Electrical Maintenance Cv Template Word

Owners Draw Quickbooks Tutorial

Quickbooks Help - How To Create A Check Register Report In Quickbooks Inside Quick Book Reports Templates - Great Cre Quickbooks Help Quickbooks Check Register

Quickbooks-job-costing-job-wip-summary-report - Quickbooks Data Migrations Data Conversions

Custom Reports In Quickbooks Desktop - Working With The Paid Filter - Youtube

Solved How Do I Get Totals To Show Up On A Check Detail R

Minutes Matter - In The Loop Paying Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

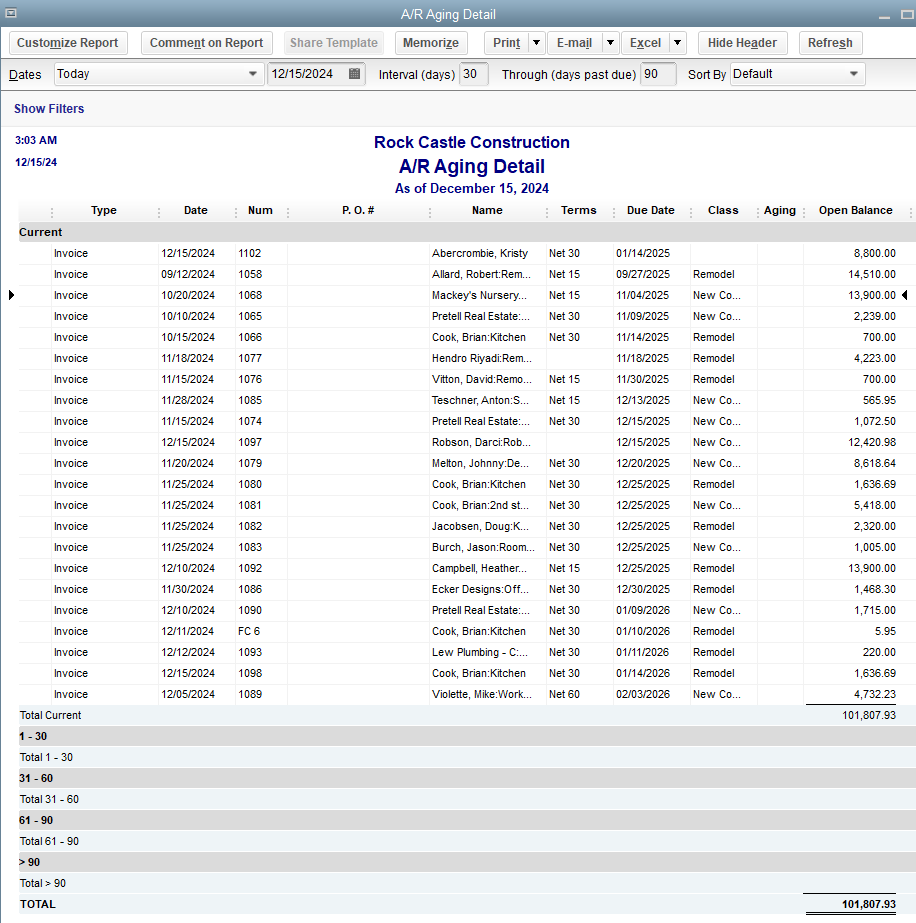

Accounts Receivable Aging Report

Pin On Myonepro

Quickbooks Owner Draws Contributions - Youtube