Example the first of two equal instalments are paid from the company’s bank for 1,00,000 against an unsecured loan of 2,00,000 at 10% p.a. 1.2.4 delayed draw debt a reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt, provided it is drawn within a specified time period (i.e., the reporting entity gets to choose the date that the debt funds within a specified time frame).

Does Ifrs 15 Or Ifrs 9 Apply To Fees Charged To Customers By Lenders - Bdo Australia

The panel will review the evolving uses of delayed draw term loans (ddtls) in leveraged buyouts (lbos) and other private equity transactions and critical points of negotiation, including conditions precedent to making draws, ticking fees, loan term, and fronting arrangements in syndicated deals.

Delayed draw term loan accounting. However, there is some risk that the lender will be unable to loan money on terms equivalent or better than it obtained from the borrower who is repaying early if, for example, interests rates may have declined since the lender originally made the loan to the borrower. Your small business should receive funding for paying the business owner’s payroll or compensation (up to $8,333 a month). Depending on its facts and circumstances, the borrower may be required to:

(or, in the case of payments to the administrative agent, as determined by the administrative agent) as follows: Delayed draw term loans subject to the terms and conditions set forth herein, each delayed draw term lender severally agrees to make to the borrowers delayed draw term loans denominated in dollars in an aggregate principal amount that will not result in the aggregate principal amount at such time of all outstanding delayed draw term loans exceeding the aggregate delayed draw term loan. Term loans come with consistency and stability that can help borrowers in financial forecasting.

A client took a term loan from the bank and paid some percentage of the total loan value as management fee. 3.4.13 delayed draw term loan when a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender, we believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10% test since the commitment is not funded on the modification date. (i) first, to the payment of any amounts owing by such defaulting lender to the administrative agent hereunder;

Borrowers need fixed assets with higher market value to pledge as collateral. The ddtl typically has specific. (ii) second, to any other lender which has made a covering advance to fund the defaulting lender’s share of any advance which the defaulting lender has failed to fund;

(you just look at the wages amounts shown in your payroll records and tax filings.). Ppp loan accounting tip #4: Some key limitations of a term loan:

Will a drawdown loan appear on my credit report? This management fee is non refundable even the client later decided not to with draw. Often, working capital loans are used to help companies bridge financial gaps, such as the time delay between the collection of accounts receivable and the need to repay debt or accounts payable.

Term debt is a loan with a set payment schedule over several months or years. This cle course will discuss the terms and structuring of delayed draw term loans. When a borrower repays its loans early, the lender must reinvest the repayments to earn acceptable returns.

The lender needs to review all the documents, order and approve inspections, and verify that all the work claimed to be completed, has been. The need to bridge financial gaps is often seen in businesses that are seasonal or cyclical. For example, say you borrow $50,000 and pay the money back with monthly payments over five years.

This draw approval process ideally takes about seven business days. A drawdown loan (sometimes known as a drawdown facility) is a loan which enables you to take out further advances with very little formality. Ddtls were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity (often for future acquisitions or expansions) but wanted to delay the incurrence of the additional debt.

Providing your lender shares the credit agreement with the credit reference agencies, then you can expect your account to appear on your credit report, showing the current balance, account status and more. Debt accordions are provisions that allow a borrower to expand the maximum allowed on a credit line or add a term loan to a credit agreement. However, depending on the size, complexity, and amount of draw request documents, this can take much longer.

Say usd 200 million term loan and.05% management fee in order to activate the facility with the bank. A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives. Show journal entry for loan payment in year 1 & year 2.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Financing Fees Deferred Capitalized Amortized - Wall Street Prep

Ikb7sbbd8huwxm

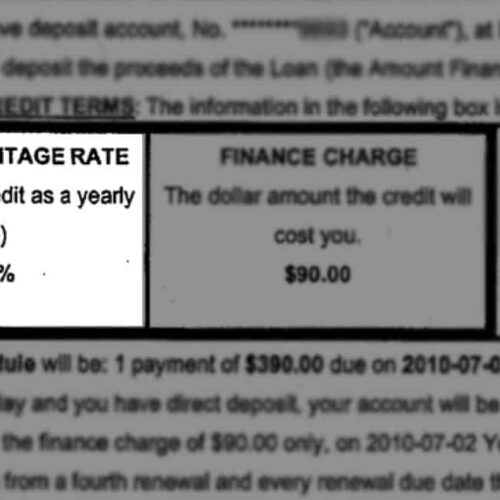

In Trouble From An Online Payday Loan You Might Not Have To Repay It Center For Public Integrity

Financing Fees Deferred Capitalized Amortized - Wall Street Prep

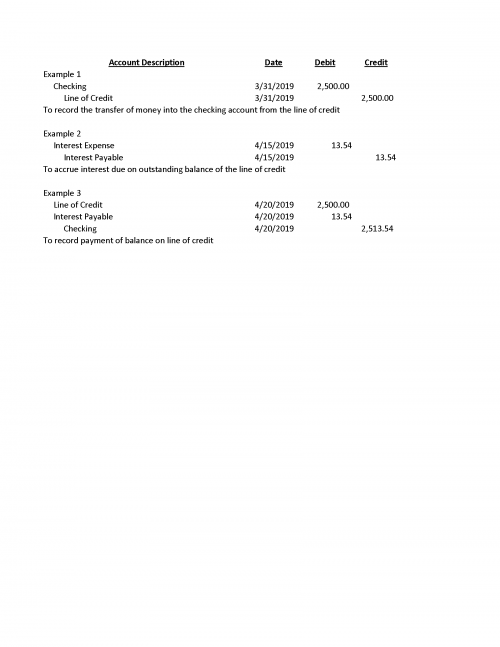

Line Of Credit Nonprofit Accounting Basics

Implementing Accrual Accounting In The Public Sector In Technical Notes And Manuals Volume 2016 Issue 006 2016

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

Balance Sheet Definition Formula Examples

Collection Invoice Flowchart Flow Chart Process Flow Chart Business Analyst

The Benefits Of Long-term Vs Short-term Financing

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Finance Investing Accounting And Finance

Advanced Lbo Modeling Test 4 Hour Example Excel Template - Wall Street Prep

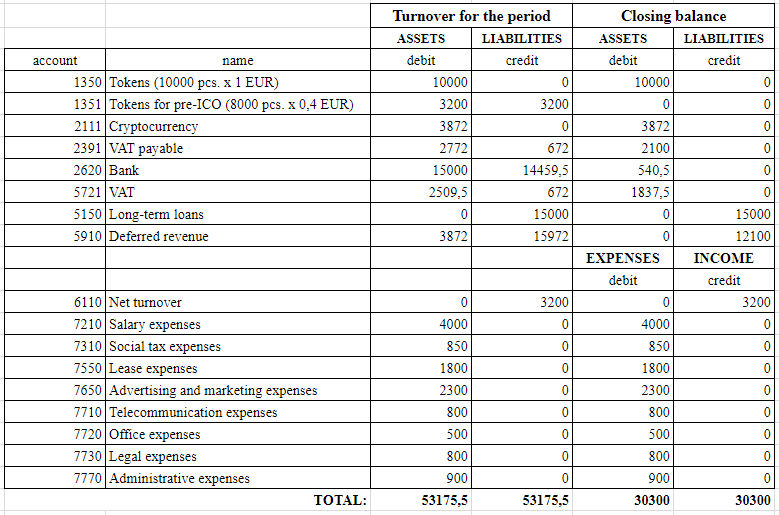

Token Accounting In Eu On Example From Accounting In Latvia By Alexander Suslenkov Msc Blockvis Medium

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Financing Fees Deferred Capitalized Amortized - Wall Street Prep

Implementing Accrual Accounting In The Public Sector In Technical Notes And Manuals Volume 2016 Issue 006 2016

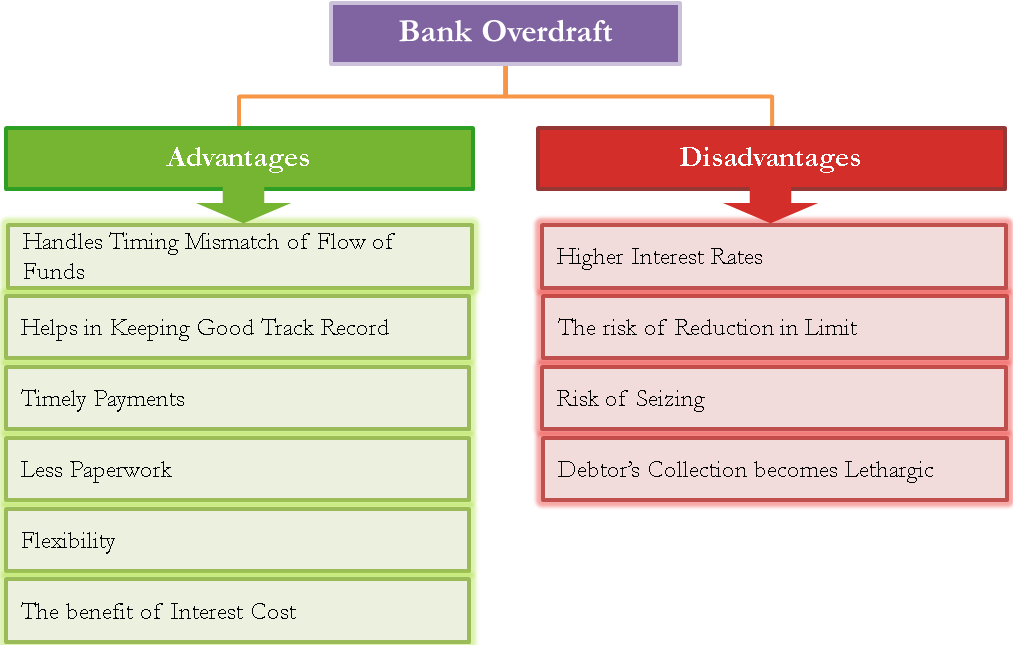

Advantages And Disadvantages Of Bank Overdraft

/GettyImages-175520675-fad3bb7af6aa4da48f02d47ba57a7432.jpg)

Mezzanine Debt Definition

Solved Whats The Correct Way To Set Up A Directors Loan Account In Quickbooks Online Uk We Have Two Directors Of A Ltd Company